You are here

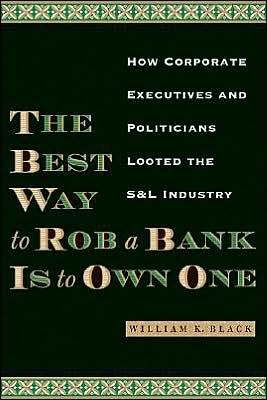

William K. Black - The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L Industry (2005)

Primary tabs

| Size | Seeds | Peers | Completed |

|---|---|---|---|

| 3.33 MiB | 0 | 0 | 0 |

William K. Black - The Best Way to Rob a Bank Is to Own One: How Corporate Executives and Politicians Looted the S&L Industry (2005)

The catastrophic collapse of companies such as Enron, WorldCom, ImClone, and Tyco left angry investors, employees, reporters, and government investigators demanding to know how the CEOs deceived everyone into believing their companies were spectacularly successful when in fact they were massively insolvent. Why did the nation's top accounting firms give such companies clean audit reports? Where were the regulators and whistleblowers who should expose fraudulent CEOs before they loot their companies for hundreds of millions of dollars?

In this expert insider's account of the savings and loan debacle of the 1980s, William Black lays bare the strategies that corrupt CEOs and CFOs—in collusion with those who have regulatory oversight of their industries—use to defraud companies for their personal gain. Recounting the investigations he conducted as Director of Litigation for the Federal Home Loan Bank Board, Black fully reveals how Charles Keating and hundreds of other S&L owners took advantage of a weak regulatory environment to perpetrate accounting fraud on a massive scale. He also authoritatively links the S&L crash to the business failures of the early 2000s, showing how CEOs then and now are using the same tactics to defeat regulatory restraints and commit the same types of destructive fraud.

Black uses the latest advances in criminology and economics to develop a theory of why "control fraud"—looting a company for personal profit—tends to occur in waves that make financial markets deeply inefficient. He also explains how to prevent such waves. Throughout the book, Black drives home the larger point that control fraud is a major, ongoing threat in business that requires active, independent regulators to contain it. His book is a wake-up call for everyone who believes that market forces alone will keep companies and their owners honest.

"Persons interested in the economics of fraud, the S&L debacle, the problems of financial regulation, and microeconomics more broadly will find this book to be very important. It is a marvelous combination of insider experiences, well-grounded generalizations, and the foundations of a broader research agenda. It merits a wide readership and, one hopes, sustained reflection on its arguments and conclusions."

—Journal of Economic Issues

"This is an extraordinary book....No other account gives a complete picture of the control fraud that occurred in the S&L crisis....There is no one else in the whole world who understands so well exactly how these lootings occurred in all their details and how the changes in government regulations and in statutes in the early 1980s caused this spate of looting....This book will be a classic."

—George A. Akerlof, University of California, Berkeley, winner of the 2001 Nobel Prize for Economics

"This book is a must-read for anyone wanting to understand one of the darkest chapters in financial history in America. As Black clearly and expertly shows, the lessons we never learned are still important....His book more than stands on its own against any other published on the S&L crisis and is the most definitive account available."

—Henry N. Pontell, University of California, Irvine, coauthor of Profit Without Honor: White-Collar Crime and the Looting of America

"William Black hits the bull's eye with his development of theconcept of 'control fraud' in The Best Way to Rob a Bank Is to Own One. Calculated dishonesty by people in charge is at the heart of most large corporate failures and scandals, such as the savings and loan debacle, as Black points out. While people chase around for other explanations, these control fraud criminal acts are right there for all to see. Black does a great service by making us focus on this reality. We will better understand and possibly prevent the scandals as we see them in the spotlight of control fraud."

—Elliott Levitas, former Commissioner, National Commission on Financial Institution Reform, Recovery, and Enforcement (FIRREA), and former Member of Congress

"At its root the S&L scandal is about corrupting self-interest, political and economic. Bill Black's seminal treatment of the subject amounts, in effect, to a clarion call for the return to an old-fashioned notion of public interest. Without such an ethic, analogous transgressions will take place again and again. In this context, the story Black weaves is both historical and prophetic."

—Congressman Jim Leach, R-Iowa

WILLIAM K. BLACK is the Interim Executive Director of the University of Texas at Austin Institute of Fraud Studies and Assistant Professor of Public Affairs at the LBJ School of Public Affairs.

Publisher: University of Texas Press (2005)

ISBN: 0292706383

- Log in to post comments